Over time, the Indian stock market has changed and now provides traders and investors with a wide range of options. Demat and trading accounts, which are necessary instruments for anyone wishing to get involved in the stock market, are at the center of this financial revolution. Knowing the Demat account benefits in addition to how it works with trading can open up a world of possibilities for you as an investor, regardless of experience level.

What do you mean by a demat and trading account?

The term “dematerialized account,” or “Demat account,” refers to a digital repository where you can keep your financial assets, including bonds, shares, mutual funds, and exchange-traded funds (ETFs). Your assets are securely kept in electronic form rather than with tangible certificates.

However, a trading account serves as an intermediary between the stock exchange and your Demat account. You purchase and sell securities using the funds in this account. Your financial assets are held in the Demat account, but payments are facilitated by the trading account.

Advantages of having a demat accounts:

Safety and usability:

The days of keeping physical share certificates safe are long gone. Having a Demat account guarantees that your investments are safe, easily accessible, and impervious to theft or physical harm.

Simplified procedure:

Transactions are made easier when using a Demat account, making the process of purchasing and selling shares easy. The speed at which transactions are completed guarantees that you never lose out on chances in the market.

Diversified investment:

You can keep a range of financial instruments in one location with a Demat account, including government bonds, equities shares, and exchange-traded funds (ETFs).

Cost efficient:

A Demat account lowers transaction costs by doing away with the requirement for paper records and it saves you from extra courier fees or stamp duties!

Functions of option trading apps:

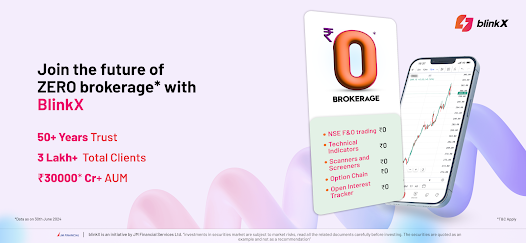

Options trading app can alter your strategy for trading if you want to go beyond conventional stock trading. These applications offer an easy-to-use interface for trading options, a derivative of the stock market that lets you speculate, hedge, or leverage your investments.

With sophisticated features like risk calculators, market analytics, and real-time data analysis, advanced options trading apps enable users to make well-informed choices. If you want to diversify your trading techniques, they’re a great addition to your arsenal of techniques.

Investing in Indian stock markets:

The stock market in India is thriving and has chances for expansion in a number of industries. The market serves an extensive range of investor preferences, including both established corporations and developing entrepreneurs.

It’s easier than ever to get started. You may easily negotiate the intricacies of the marketplace by combining a strong Demat account with a trustworthy trading account. Furthermore, you can improve your techniques by using options trading apps.

Conclusion:

Knowing how a demat and trading account work together is essential for anyone wishing to investigate the financial markets. A Demat account’s advantages extend beyond storage; they include simplicity, security, and adaptability. When you combine it with a trustworthy options trading program, you’ll be ready to take advantage of India’s vibrant stock market.

Start your financial path by making wise investments!